Prelude

What's the goal of this handbook?

To slowly start building this up:

- Critical docs: Concepts, Guides and References.

- Concepts: The internal technical detail, research and relevant topics.

- Guides: A guide on how the features can be used from a user perspective.

- User: How to interact and use the node as a regular user.

- Developer: How to interact on a deeper perspective as a developer.

- Institution: How to interact with the node for exchanges, dealing with updates, best practices etc.

- References: A to-the-point reference that's used for quick references.

- Standard practices for coding, git, things like how to add a new data structure, add rpc, etc

- Testing: how to write a test and contribute (so we can welcome external contributions too), and release checks

- Links to pink paper, external resources of all kind (a dedicated page similar to github awesome-{x} repos.

- Anything that's doesn't belong in the source code or is process related.

How do I read and write this handbook?

The book uses the simplest Markdown generator available, mdbook - intentionally.

No big features. It's simple. Any engineer should be able to learn and use it

in minutes - not hours.

Learn about it here: mdbook

Attributions

Parts of this handbook were edited from the Bitcoin Wiki.

Concepts

Blocks and the Blockchain

Each DeFiChain block consists of

- a block header: contains metadata about the block and its contents and links to previous block

- a body: contains a list of transactions in that block.

Blocks are identified by their SHA256 hashes.

Block header

The header format of DeFiChain blocks is as follows. The implementation of the block header can be found in the class CBlockHeader in file src/primitives/block.h.

| Name | Data Type | Description |

|---|---|---|

| nVersion | int32_t | Used to create and accept soft forks. Usually 536870912. For details on how nVersion is processed and used, read BIP9. |

| hashPrevBlock | uint256 | Double SHA256 hash of previous block header. |

| hashMerkleRoot | uint256 | Double SHA256 hash of merkle root of transaction merkle tree. |

| nTime | uint32_t | Unix time of when the miner started hashing the header (according to the miner). Must be strictly greater than the median time of the previous 11 blocks. |

| nBits | uint32_t | Used for PoS mining. An encoded version of the target threshold this block’s header hash must be less than or equal to. |

| uint64_t | [*No longer in use] Block height of the current block. Block height is tracked by CBlockIndex instead of block headers themselves, this remains in the block header for compatibility with previous versions of the node. Removal of this field would require a hard fork. | |

| mintedBlocks | uint64_t | Number of blocks this masternode has mined. |

| stakeModifier | uint256 | A stake modifier is a collective source of random entropy for PoS mining. It is equal to SHA256({previous stake modifier}, {masternode ID}). |

| sig | vector | Signed digest block header using miner's public key. |

Block Body

The block body consists of

- a list of pointers which map to transactions

- a local variable

fChecked(not shared between nodes) to track if the block has been successfully validated previously

The list of transactions has type vector<CTransactionRef>, and each CTransactionRef points to a CTransaction. The contents of each Transaction as well as the different types of Transactions are detailed in the Transactions document.

External Resources

- Bitcoin Block Reference

- A Decomposition Of The Bitcoin Block Header

- Bitcoin Protocol Documentation

- Blockchain Forking

Transactions

Transactions

- are used to transfer DFI and dTokens

- have inputs and outputs

- difference between inputs and outputs is considered a transaction fee

- not encrypted

- identified by their SHA256 hashes

Custom Transactions also exist to interact with dApps such as the DeX and Loans.

Transaction Format

Block bodies contain CTransaction which have the following structure:

| Name | Data Type | Description |

|---|---|---|

| nVersion | int32_t | Currently 4. |

| vin | vector | List of input transactions. |

| vout | vector | List of output transactions. |

| nLockTime | uint32_t | Block height or timestamp when transaction is final |

| hash | uint256 | Hash of transaction without witness data. |

| m_witness_hash | uint256 | Hash of transaction with witness data. |

CTxIn is an input transaction, and has the following structure:

| Name | Data Type | Description |

|---|---|---|

| prevout | COutPoint | Hash and index of transaction holding the output to spend. |

| scriptSig | CScript | Transaction unlocking script. |

| nSequence | uint32_t | Sequence number. Defaults to 0xFFFFFFFE. |

| scriptWitness | CScriptWitness | Witness data for this input transaction. |

Similar to Bitcoin's script system, a scriptPubKey must be able to unlock the respective scriptSig.

Each non-coinbase input spends an outpoint (COutPoint) from a previous transaction. Coinbase transactions set prevout to null, and encode the block height in scriptSig.

CTxOut is the output of the current transaction, and has the following structure:

| Name | Data Type | Description |

|---|---|---|

| nValue | CAmount | Amount of DFI to spend. |

| scriptPubKey | CScript | Defines the conditions which must be satisfied to spend this output. |

| nTokenId | DCT_ID | ID of token transferred. DFI has ID 0. |

Coinbase Transaction

Coinbase transactions have the following properties

- it is the first transaction in a block

- there can only be one coinbase transaction per block

- creates new DFI in mining masternode's wallet

The base block reward is split into 6 different recipients. Recipients marked with UTXO are the only outputs present in the coinbase transaction.

| Recipient | Coinbase allocation | Description |

|---|---|---|

| Masternode (UTXO) | 33.33% | Masternode rewards. Masternode also receives additional income from transaction fees. |

| Community Fund (UTXO) | 4.91% | Community fund controlled by the Foundation, used to finance DeFiChain initiatives. ref |

| Anchor | 0.02% | Fund to pay the Bitcoin transaction fee for anchoring. |

| Liquidity Pools | 25.45% | Distributed to LP providers as incentive. |

| Loans | 24.68% | Incentives for atomic swap and DeFiChain futures. |

| Options | 9.88% | Distributed to options holders. Not in use currently. |

| Unallocated | 1.73% | N/A |

External Resources

Custom Transactions

Custom Transactions are special transactions to interact with dApps on DeFiChain, such as Vaults and the DeX.

Custom transaction can be identified by the first vout of a transaction

- begin with a

OP_RETURN - followed by a

DfTxmarker (serialized in UTF as44665478) - followed by one character marker denoting the type of transaction (serialized in UTF), conversion table here

- followed by custom transaction data, if required

For example, in the following custom transaction

"vout": [

{

"value": 0.00000000,

"n": 0,

"scriptPubKey": {

"asm": "OP_RETURN 446654784301d823ad3976574a50001f4ca5a5326a1c1232a0a70000",

"hex": "6a054466547841",

"type": "nulldata"

},

"tokenId": 0

},

...

]

The custom transaction can be broken down to

| asm | Meaning |

|---|---|

| 44665478 | DfTx marker |

| 43 | C in UTF, corresponds to CreateMasternode message (CCreateMasterNodeMessage) |

| 01 | operatorType variable |

| d823ad3976574a50001f4ca5a5326a1c1232a0a7 | operatorAuthAddress variable |

| 0000 | timelock variable |

Transaction Types

Masternodes

CreateMasterNode

Creates a new masternode in the network

Marker: C

Message Format

| Variable | Data Type | Description |

|---|---|---|

| operatorType | char | 1 for P2PKH, 4 for P2WPKH |

| operatorAuthAddress | CKeyID | DeFiChain address of masternode operator |

| timelock | uint16_t | minimum time that masternode must be active, either 0, 5 or 10 years |

ResignMasternode

Removes enabled or pre-enabled masternode from network.

Marker: R

Message Format

| Variable | Data Type | Description |

|---|---|---|

| nodeID | uint256 | ID of masternode to resign |

SetForcedRewardAddress

Sets reward address for masternode.

Marker: F

| Variable | Data Type | Description |

|---|---|---|

| nodeID | uint256 | masternode ID |

| rewardAddressType | char | 1 for P2PKH, 4 for P2WPKH |

| rewardAddress | CKeyID | new DeFiChain address for rewards |

RemForcedRewardAddress

Removes reward address for masternode if any.

Marker: f

| Variable | Data Type | Description |

|---|---|---|

| nodeID | uint256 | masternode ID |

UpdateMasternode

Updates masternode metadata.

Marker: m

Message Format

| Variable | Data Type | Description |

|---|---|---|

| operatorType | char | 1 for P2PKH, 4 for P2WPKH |

| operatorAuthAddress | CKeyID | DeFiChain address of masternode operator |

| timelock | uint16_t | minimum time that masternode must be active, either 0, 5 or 10 years |

Custom Tokens

CreateToken

Creates new custom token.

Marker: T

Message Format

| Variable | Data Type | Description |

|---|---|---|

| token | CToken | token definition |

Class CToken has the following structure

| Variable | Data Type | Description |

|---|---|---|

| symbol | string | token ticker |

| name | string | name of token |

| decimal | uint8_t | how divisible a token can be, fixed to 8 |

| limit | CAmount | deprecated |

| flags | uint8_t | sets options for token |

The following flags are available for a token:

| Bit index | Flag |

|---|---|

| 0 | None |

| 1 | Mintable |

| 2 | Tradeable |

| 3 | DeFi Asset Token (tokens backed by collateral, e.g. dBTC) |

| 4 | Liquidity Pool Share |

| 5 | Finalized |

| 6 | Loan Token |

| 7 | Unused |

Tokens are mintable and tradeable by default.

MintToken

Mints new custom tokens.

Marker: M

Message Format

| Variable | Data Type | Description |

|---|---|---|

| balances | CBalances | amount and type of token to mint |

UpdateToken

Set DAT flag for a token to true or false. Deprecated.

Marker: N

| Variable | Data Type | Description |

|---|---|---|

| tokenTx | uint256 | CreateToken transaction for a custom token |

| isDAT | bool | is token a DAT |

UpdateTokenAny

Update a token, supports all fields in CToken.

Marker: n

| Variable | Data Type | Description |

|---|---|---|

| balances | CBalances | amount and type of token to mint |

DeX

CreatePoolPair

Create new liquidity pool.

Marker: p

Message Format

| Variable | Data Type | Description |

|---|---|---|

| poolPair | CPoolPairMessage | metadata for liquidity pool |

| pairSymbol | string | name of liquidity pool |

| rewards | CBalances | percentage of coinbase liquidity rewards allocated to pool |

CPoolPairMessage has the following message structure:

| Variable | Data Type | Description |

|---|---|---|

| idTokenA | DCT_ID | token ID for first token in LP |

| idTokenB | string | token ID for second token in LP |

| commission | CAmount | define fees for swap |

| ownerAddress | CScript | owner of DeX pool |

| status | bool | pool status (active/inactive) |

UpdatePoolPair

Update a liquidity pool.

Marker: u

Message Format

| Variable | Data Type | Description |

|---|---|---|

| poolId | DCT_ID | pool ID |

| status | bool | set pool status (active/inactive) |

| commission | CAmount | define fees for swap |

| ownerAddress | CScript | owner of DeX pool |

| rewards | CBalances | percentage of coinbase liquidity rewards allocated to pool P2WPKH |

PoolSwap

Swap tokens using a liqidity pool. Deprecated.

Marker: s

Message Format

| Variable | Data Type | Description |

|---|---|---|

| from | CScript | transaction input |

| to | CScript | transaction output |

| idTokenFrom | DCT_ID | input token ID |

| idTokenTo | DCT_ID | output token ID |

| amountFrom | CAmount | amount of tokens to swap |

| maxPrice | PoolPrice | maximum possible price |

PoolSwapV2

Swap tokens using a liqidity pool. Has 16 digits precision instead of 8 in V1.

Marker: i

Message Format

| Variable | Data Type | Description |

|---|---|---|

| swapInfo | CPoolSwapMessage | swap metadata (contents of V1 message) |

| poolIDs | vector<DCT_ID> | IDs of pools to swap with |

AddPoolLiquidity

Mint LP tokens and add liquidity to a liquidity pool.

Marker: l

Message Format

| Variable | Data Type | Description |

|---|---|---|

| from | CAccounts | dToken input |

| shareAddress | CScript | address for LP rewards |

RemovePoolLiquidity

Redeem LP tokens and withdraw liquidity from a liquidity pool.

Marker: r

Message Format

| Variable | Data Type | Description |

|---|---|---|

| from | CAccounts | LP token input |

| amount | CTokenAmount | withdrawal amount |

Accounts

UtxosToAccount

Spend UTXOs from a wallet and transfer tokens to to any DeFiChain address.

Marker: U

Message Format

| Variable | Data Type | Description |

|---|---|---|

| to | CAccounts | account and amount of tokens to send |

AccountToUtxos

Creates UTXO from a wallet account.

Marker: b

Message Format

| Variable | Data Type | Description |

|---|---|---|

| from | CScript | UTXOs to spend |

| balances | CBalances | amount of DFI to send |

| mintingOutputsStart | uint32_t | number of transaction outputs |

AccountToAccount

Transfer tokens between a wallet and any DeFiChain address.

Marker: B

Message Format

| Variable | Data Type | Description |

|---|---|---|

| from | CScript | UTXOs to spend |

| to | CBalances | account to send tokens to |

AnyAccountsToAccounts

Transfer tokens from any DeFiChain address to any DeFiChain address.

Marker: a

Message Format

| Variable | Data Type | Description |

|---|---|---|

| from | CScript | UTXOs to spend |

| to | CBalances | account to send tokens to |

SmartContract

Interact with DFIP2201 contract.

Marker: K

Message Format

| Variable | Data Type | Description |

|---|---|---|

| name | string | name of the smart contract |

| accounts | CAccounts | account and amount of tokens to send |

DFIP2203

Interact with DFIP2203 (Futures) contract.

Marker: Q

Message Format

| Variable | Data Type | Description |

|---|---|---|

| owner | CScript | address to fund contract and recieve token |

| source | CTokenAmount | amount of tokens to fund future contract |

| destination | uint32_t | set underlying asset (if source id DUSD) |

| withdraw | bool | withdraw asset to owner address |

Governance

SetGovVariable

Update governance variables.

Marker: G

Message Format

| Variable | Data Type | Description |

|---|---|---|

| govs | map<shared_ptr | list of variables and values to update |

SetGovVariableHeight

Set one governance variable at a particular block height.

Marker: j

Message Format

| Variable | Data Type | Description |

|---|---|---|

| govs | shared_ptr | variable name and value to update |

| startHeight | uint32_t | height at which change is in effect |

Authorisation

AutoAuthPrep

This is an empty custom transaction.

Marker: A

Oracles

AppointOracle

Create new oracle at an address.

Marker: o

Message Format

| Variable | Data Type | Description |

|---|---|---|

| oracleAddress | CScript | address of new oracle |

| weightage | uint8_t | oracle weightage |

| availablePairs | set | set of token prices available |

RemoveOracleAppoint

Remove existing oracle.

Marker: h

Message Format

| Variable | Data Type | Description |

|---|---|---|

| oracleId | COracleId | oracle ID |

UpdateOracleAppoint

Update existing oracle.

Marker: t

Message Format

| Variable | Data Type | Description |

|---|---|---|

| oracleId | COracleId | oracle ID |

| newOracleAppoint | CAppointOracleMessage | new oracle metadata (contents of AppointOracle message) |

SetOracleData

Update oracle prices.

Marker: y

Message Format

| Variable | Data Type | Description |

|---|---|---|

| oracleId | COracleId | oracle ID |

| timestamp | int64_t | timestamp of oracle data |

| prices | CTokenPrices | array of price and token strings |

Interchain Exchange (ICX)

ICX is currently disabled on the mainnet.

ICXCreateOrder

Create ICX order.

Marker: 1

Message Format

| Variable | Data Type | Description |

|---|---|---|

| orderType | uint8_t | is maker buying or selling DFI |

| idToken | DCT_ID | token ID on DeFiChain |

| ownerAddress | CScript | address for funding DeFiChain transaction fees |

| receivePubkey | CPubKey | public key which can claim external HTLC |

| amountFrom | CAmount | amount of asset to be sold |

| amountToFill | CAmount | amount of tokens in order available to fill |

| orderPrice | CAmount | quoted price of asset |

| expiry | uint32_t | block height for order expiry |

ICXMakeOffer

Make an offer for an ICX order.

Marker: 2

Message Format

| Variable | Data Type | Description |

|---|---|---|

| orderTx | uint256 | transaction ID of order |

| amount | CAmount | amount of asset to swap |

| ownerAddress | CScript | address for funding DeFiChain transaction fees |

| receivePubkey | CPubKey | public key which can claim external HTLC |

| expiry | uint32_t | block height for order expiry |

| takerFee | CAmount | taker fee |

ICXSubmitDFCHTLC

Submit a DFI hash time lock contract (HTLC) for offer.

Marker: 3

Message Format

| Variable | Data Type | Description |

|---|---|---|

| offerTx | uint256 | transaction ID of offer |

| amount | CAmount | amount to put in HTLC |

| hash | uint256 | hash of seed used for the hash lock |

| timeout | uint32_t | timeout for expiration of HTLC in DeFiChain blocks |

ICXSubmitEXTHTLC

Submit a BTC hash time lock contract (HTLC) for offer.

Marker: 4

Message Format

| Variable | Data Type | Description |

|---|---|---|

| offerTx | uint256 | transaction ID of offer |

| amount | CAmount | amount to put in HTLC |

| hash | uint256 | hash of seed used for the hash lock |

| htlcscriptAddress | string | script address of external htlc |

| ownerPubkey | CPubKey | refund address in case of HTLC timeout |

| timeout | uint32_t | timeout for expiration of HTLC in DeFiChain blocks |

ICXClaimDFCHTLC

Claim a DFI HTLC.

Marker: 5

Message Format

| Variable | Data Type | Description |

|---|---|---|

| dfchtlcTx | uint256 | transaction ID of DeFiChain HTLC |

| seed | vector | secret seed for claiming HTLC |

ICXCloseOrder

Close an ICX order.

Marker: 6

Message Format

| Variable | Data Type | Description |

|---|---|---|

| orderTx | uint256 | transaction ID of ICX order |

ICXCloseOffer

Close an ICX offer.

Marker: 7

Message Format

| Variable | Data Type | Description |

|---|---|---|

| offerTx | uint256 | transaction ID of ICX offer |

Loans

SetLoanCollateralToken

Sets what tokens are allowed as collateral.

Marker: c

Message Format

| Variable | Data Type | Description |

|---|---|---|

| idToken | DCT_ID | token ID |

| factor | CAmount | minimum collateralization ratio |

| fixedIntervalPriceId | CTokenCurrencyPair | oracle price for current loan period |

| activateAfterBlock | uint32_t | block number at which change will be activated |

SetLoanToken

Sets loan token.

Marker: g

Message Format

| Variable | Data Type | Description |

|---|---|---|

| symbol | string | ticker for loan token |

| name | string | name of loan token |

| fixedIntervalPriceId | CTokenCurrencyPair | oracle price for current loan period |

| mintable | bool | token's mintable property, defaults to true |

| interest | CAmount | interest rate for the token |

UpdateLoanToken

Update loan token.

Marker: x

Message Format

| Variable | Data Type | Description |

|---|---|---|

| tokenTx | uint256 | token creation tx |

| symbol | string | ticker for loan token |

| name | string | name of loan token |

| fixedIntervalPriceId | CTokenCurrencyPair | oracle price for current loan period |

| mintable | bool | token's mintable property, defaults to true |

| interest | CAmount | interest rate for the token |

LoanScheme

Create a loan scheme.

Marker: L

Message Format

| Variable | Data Type | Description |

|---|---|---|

| identifier | string | loan scheme identifier |

| updateHeight | uint64_t | block height to create scheme at |

| ratio | uint32_t | minimum collateralization ratio |

| rate | CAmount | interest rate |

DefaultLoanScheme

Set default loan scheme.

Marker: d

Message Format

| Variable | Data Type | Description |

|---|---|---|

| identifier | string | loan scheme identifier |

DestroyLoanScheme

Delete existing loan scheme.

Marker: D

Message Format

| Variable | Data Type | Description |

|---|---|---|

| identifier | string | loan scheme identifier |

| destroyHeight | uint64_t | block height to destroy scheme at |

Vault

Create new vault.

Marker: V

Message Format

| Variable | Data Type | Description |

|---|---|---|

| ownerAddress | CScript | owner of vault |

| schemeId | string | loan scheme to use |

CloseVault

Close existing vault.

Marker: e

Message Format

| Variable | Data Type | Description |

|---|---|---|

| vaultId | CVaultId | ID of vault |

| to | CScript | address to send collateral to |

UpdateVault

Update existing open vault.

Marker: v

Message Format

| Variable | Data Type | Description |

|---|---|---|

| vaultId | CVaultId | ID of vault |

| ownerAddress | CScript | owner of vault |

| schemeId | string | loan scheme to use |

DepositToVault

Deposit collateral in a vault.

Marker: S

Message Format

| Variable | Data Type | Description |

|---|---|---|

| vaultId | CVaultId | ID of vault |

| from | CScript | address funding the vault |

| amount | CTokenAmount | amount of tokens to deposit |

WithdrawFromVault

Withdraw collateral in a vault.

Marker: J

Message Format

| Variable | Data Type | Description |

|---|---|---|

| vaultId | CVaultId | ID of vault |

| to | CScript | address to send collateral to |

| amount | CTokenAmount | amount of tokens to deposit |

TakeLoan

Mint loan token against a loan vault.

Marker: X

Message Format

| Variable | Data Type | Description |

|---|---|---|

| vaultId | CVaultId | ID of vault |

| to | CScript | address to send loan tokens to |

| amount | CBalances | amount of loan token to mint |

PaybackLoan

Repay an existing loan. Deprecated.

Marker: H

Message Format

| Variable | Data Type | Description |

|---|---|---|

| vaultId | CVaultId | ID of vault |

| from | CScript | address repaying the loan |

| amount | CBalances | amount of loan token to repay |

PaybackLoanV2

Repay an existing loan.

Marker: k

Message Format

| Variable | Data Type | Description |

|---|---|---|

| vaultId | CVaultId | ID of vault |

| from | CScript | address repaying the loan |

| loans | map<DCT_ID, CBalances> | amount of loan token to repay |

AuctionBid

Bid for an auction on a vault.

Marker: I

Message Format

| Variable | Data Type | Description |

|---|---|---|

| vaultId | CVaultId | ID of vault |

| index | uint32_t | auction index |

| from | CScript | address to recieve vault collateral |

| amount | CTokenAmount | bid amount |

FutureSwapExecution

Unimplemented

Marker: q

FutureSwapRefund

Unimplemented

Marker: w

Protocol and Network

This is a working version of the Pink Paper for DeFiChain.

Comments and pull requests are welcomed.

Goals

- Lay out the roadmap for DeFiChain for the next few quarters, esp. 2021/2022.

- To form the basis of an open discussion with DeFiChain community on the direction of the project.

- Provide a general product and design direction for the engineering team.

Sections

| # | Topic | Remarks |

|---|---|---|

| 1 | Introduction | This document. |

| 2 | Emission rate | Under implementation. Targeting May 2021 upgrade. |

| 3 | Governance | Also community development fund management. Under implementation. Targeting May 2021 upgrade. |

| 4 | Price oracle | Under implementation. Targeting May 2021 upgrade. |

| 5 | Interchain exchange (ICX) | Also Bitcoin atomic swap. Under implementation. Targeting May 2021 upgrade. |

| 6 | Fees | Draft. Partial implementation. |

| 7 | Futures | Early draft. |

| 8 | Operator | Early draft. |

| 9 | Loan & decentralized tokenization | Early draft. |

| 10 | Automated options | Early draft. |

| 11 | Non-Fungible Token (NFT) | Early draft. |

See also

Disclaimers

- Content may be updated without notice.

- Content does not guarantee implementation and does not imply implementation order.

- Actual implementation may differ from the paper.

- This my no means signify acceptance by the DeFiChain users and masternode owners.

DFI emission rate

Current

From white-paper:

DeFiChain is initially launched with a 200 DFI block reward, of which 10% goes to the community fund. The Foundation pledges to guarantee this 200 DFI block reward for at least 1,050,000 blocks since the the first genesis block, so approximately 1 year.

The white paper lays out the expectation for the first year that the block reward is flat at 200 DFI.

2 DFIPs have since been made and implemented that affected the allocation of the 200 DFI, while the total emission remains consistent at 200 DFI.

- DFIP #1: Bitcoin anchor reward source and mechanics adjustments where 0.1 DFI is reduced from community fund to cater for anchor reward

- DFIP #2: DeFi incentive funding where the original 180 DFI per block mining reward is reduced to 135 DFI

To keep the total supply of DFI capped at 1.2 billion, the emission rate of DFI cannot stay consistent forever and will have to be reduced over time.

Foundation and Community Fund

To further decentralize the governance of DeFiChain, the Foundation's role must be diminished significantly, and should not be holding any DFI. As such, it is proposed for the Foundation tokens to be burned entirely so no individuals or entities hold the private keys to the Foundation's DFI.

Community Fund today accumulates at 19.9 DFI per block and requires community funding proposal (CFP) to be made and votes to be called for the fund to be manually released.

Community Fund should be removed from address with private key to consensus-managed on-chain voting.

Emission rate

Goals

- Maintain the same emission rate on the first cycle.

- Avoid the dramatic "halving" like Bitcoin's.

- Maintain the 1.2 billion DFI cap.

- Maintain a steady expected emission rate for foreseeable future.

Current rate

The current emission rate of DFI is 258.1 DFI per block – some of it are funded by airdrop fund.

| Description | DFI per block |

|---|---|

| Mining reward | 135 |

| Community fund | 19.9 |

| Anchor reward | 0.1 |

| DeFi incentives | |

| BTC-DFI | 80 |

| ETH-DFI | 15 |

| USDT-DFI | 5 |

| LTC-DFI | 2 |

| BCH-DFI | 1 |

| DOGE-DFI | 0.1 |

| TOTAL | 258.1 |

The same rate will be retained on the first cycle.

On top of the above, the following will also be pre-allocated on the first cycle:

| Description | In use today? | DFI per block | Proportion |

|---|---|---|---|

| Mining reward | Yes | 135 | 33.33% (guaranteed) |

| Community fund | Yes | 19.9 | 4.91% |

| Anchor reward | Yes | 0.1 | 0.02% |

| DEX liquidity mining | Yes | 103.1 | 25.45% |

| Atomic swap incentives | No | 50 | 12.34% |

| Futures incentives | No | 50 | 12.34% |

| Options incentives | No | 40 | 9.88% |

| Unallocated incentives | No | 6.94 | 1.71% |

| TOTAL | 405.04 | 100% |

Cycle & Reduction

Emission rate will start at 405.04 DFI on the first cycle so that it flows smoothly with no change before the implementation. The increment on the first cycle is coming from the destruction of Foundation-owned DFI.

Cycle period is 32,690 blocks, at 37 seconds per block, each cycle takes approximately 2 weeks.

Every cycle, the block reward reduces by 1.658%. The splitting of the rewards for respective incentives will be maintained at the same proportion as laid out on the schedule above.

Unused reward will be burned. Burned rewards will not be re-introduced, therefore counted towards the 1.2 billion supply cap.

Rewards proposed may be adjusted with future on-chain governance changes, however, masternode (mining) rewards are guaranteed to be 33.33% of the total block reward.

Fees on DeFiChain

Usage of DeFiChain generally consists of the following fees:

- Miner fee

- Operator fee

- DeFi fee

Miner fee

Miner fee is the small fee, paid in UTXO DFI, to masternodes (also referred to as miners) for transaction validation and inclusion in a block.

This works the same as Bitcoin blockchain, measured in data size, e.g. price per byte.

Operator fee

As part of DeFiChain generalization, many services will soon be run by operators.

For providing of services and applications on DeFiChain, operators are able to determine fees for the services that they would charge freely. Fees can be in any form of tokens, DFI or operators' own tokens, or a combination of multiple tokens. What an operator chooses to do with the operator fee is at the operator's discretion.

DeFi fee

DeFi fee is charged for all DeFi transactions on DeFiChain regardless of operators.

Fee schedule

All fees are burned in a trackable and transparent manner.

The following fees are for illustrative purposes only and have yet to be fully determined.

| Operations | Burn amount (in DFI) |

|---|---|

| Masternode | |

| Registration | 10 |

| Operator | |

| Registration | 1000 |

| Tokenization | |

| Create a new token | 100 |

| Liquidity pool | |

| Create pool | 300 |

| Swap (for non-DFI pairs) | 0.01 |

| Governance | |

| Initiate community fund request | 5 |

| Initiate vote of confidence | 25 |

| Initiate block reward reallocation proposal | 250 |

| Interchain exchange | |

| Atomic swap | 0.01 |

| Oracle | |

| Create price feed | 100 |

| Appoint oracle | 20 |

| Loan | |

| Loan interest | TBD |

| Liquidation fee | TBD |

| Option pool | |

| Create pool | 300 |

| Option contract creation | 0.01 |

| Bonus payout fee | TBD |

| Future | |

| Create future market | 300 |

| Trade fee | TBD |

Futures

Stocks, commodities and real-world tokenization will be offered on DeFiChain via futures contract, offered by Operators.

Future is offered by operators with the assistance of price oracles, allowing prices of assets to be tracked, real world or otherwise.

DeFiChain will support 2 types of futures:

- Fixed expiry

- With a fixed expiry at a certain date in the future.

- At the time of expiry,

- Perpetual swap

- With funding mechanics

Mechanics

- Margin contract

- Trader is able to fund their Future trading position through this margin contract.

- Contract can be funded with DFI and other tokens that operators decide, e.g. BTC.

- Operator can also define initial margin and maintenance margin for a margin contract.

- Asset

- Operator decide assets to list.

- Assets can be stocks, commodities or anything that has a price. It is operator's responsibility to ensure that there are good price oracles for traded assets.

- Order

- User is able to make an order. It can be a long or short order.

- Orders are matched automatically on-chain.

- Settlement

- Fixed expiry future will be settled automatically based on settlement oracle price published.

- Perpetual swap future has no settlement. There is instead a funding rate mechanism.

- Perpetual swap funding

- Funding rate is automatically determined by DeFiChain based on fixed algorithm: oracle price, perpetual swap trading price.

- Funding period can be set by operator, but it should be between 1x to a max of 12x per day. For reference, most centralized perpetual swap offerings have a 8h funding interval (3x per day).

- Liquidation

- When net margin (total margin + unrealized PnL) is less than maintenance margin, forced liquidation would occur.

- TBD: Either automated, operator-run, or community-run with incentives.

Enahncements

- Future can further be enhanced to allow leverage. DeFiChain will start with no leverage (1x) and will introduce leverage once the mechanisms are stable.

RPC

TK

On-chain Governance

Governance summary

Voting is carried out every 130,000 blocks, roughly once every calendar month.

Types of governance:

-

Community development fund request proposal

- Requesting of community development fund.

- Requires simple majority (> 50%) by non-neutral voting masternodes to pass.

- Fee: 10 DFI per proposal

-

Block reward reallocation proposal

- Note the miner's reward (PoS) are guaranteed and cannot be reallocated.

- Requires super majority (> 66.67%) by non-neutral voting masternodes to pass.

- Fee: 500 DFI per proposal

-

Vote of confidence

- General directional vote, not consensus enforceable.

- Requires super majority (> 66.67%) by non-neutral voting masternodes to pass.

- Fee: 50 DFI per proposal

All fees are trackably burned.

Community fund request proposal (CFP)

Current

Currently every block creates 19.9 DFI to community fund address that is controlled by Foundation.

Improvements

The amount at dZcHjYhKtEM88TtZLjp314H2xZjkztXtRc will be moved to a community balance, we call this the "Community Development Fund".

This fund, will be similar to Incentive Funding and Anchor Reward, they have no private keys and are unrealized by default unless allocated.

Voting is carried our every 90,000 blocks (roughly once every calendar month). This should be configurable as chainparams and requires a hardfork to update. The block where the vote is finalized is also known as "Voting Finalizing Block".

User is able to submit a fund request that is to be voted by masternodes. Each fund request costs non-refundable 10 DFI. The 10 DFI is not burned, but being added to the proposal for that will be paid out to all voting masternodes to encourage participation. Each fund request can be also specify cycle. Cycle is defaulted to 1 for one-off fund request, this also allows for periodic fund requests where a request is for a fixed amount to be paid out every cycle (every 90,000 blocks) for the specified cycles if the funding request remains APPROVED state.

Data structure of a funding request

User submitted data

- Title (required, this may also be implemented as hash of title to conserve on-chain storage)

- Payout address (required) this can be different from requester's address

- Finalize after block (optional, default=curr block + (blocks per cycle / 2))

- Max valid value would be curr block + 3 * blocks per cycle. No minimum.

- The rationale for this value is to allow sufficient time for requests to be discussed and voted on, esp. when it is submitted closer to the end of current voting cycle.

- Amount per period (in DFI)

- Period requested (required, integer, default=1)

Internal data

- Completed payment periods (integer)

- State

- Voting data

States of funding request

Funding requests can have one of the following states

VOTING: Successfully submitted request, currently undergoing voting stateREJECTED: At voting finalizing block, if a request does not achieve. This is a FINAL state and cannot be re-opened.COMPLETED: A funding request that has been paid out entirely. When completed payment periods is equals to period requested, request is marked asCOMPLETED. . This is a FINAL state and cannot be re-opened.

The absence of the state APPROVED is intended. An approved request will simply have its payout made and increment the completed payment period. If payment has been completed fully, request state will be changed to COMPLETED, which is a final state. A corollary to this allows for a request that requested for a payout of 1000 DFI every month and has received for 2 months to be rejected at the 3rd month if there are more no votes to yes votes.

RPC

-

creategovcfr '{DATA}'DATAis serialized JSON with the following:titlefinalizeAfter: Defaulted to current block height + 90000/2. All eligible proposals have to be submitted at least 90k blocks before the finalizing block and not more than 270k blocks before.cycles: Defaulted to1if unspecified.amount: in DFI.payoutAddress: DFI address

- 10 DFI is paid along with the submission.

- Request is finalized after submission, no edits are possible thereafter.

- Returns

txid. Thetxidis also used as the proposal ID.

-

vote PROPOSALID DECISIONPROPOSALIDis thetxidof the submitted funding request.DECISIONcan be either of the following:yesnoneutral

- A masternode is able to change the vote decisions before the request is finalized, the last vote as seen on the block BEFORE finalizing block is counted.

Votes

A masternode is deemed to be eligible to cast a vote if ALL the following conditions are satisfied:

- The masternode is in

ENABLEDstate during vote submission AND at vote finalizing block. - The masternode has successfully minted at least 1 block during vote submission AND at vote finalizing block.

Any eligible masternodes can cast a vote to any proposal that is in VOTING state, regardless of completed payment period.

Masternodes are able to cast any of the following votes:

- YES

- NO

- NEUTRAL

At every vote finalizing block, a community fund proposal (CFP) is deemed to be eligible to be paid out of all the followings are true:

- There are more YES votes than NO votes. Simple majority wins. NEUTRAL votes are not counted. If there are equal amount of YES and NO votes, the CFR is deemed to have failed and rejected.

- The voting masternodes eligibility must be

ENABLEDat the finalizing block and have mined at least 1 block. - Quorum: All proposals require at least 1% of voting masternodes of all active masternodes that mined at least 1 block before the finalizing block.

Other proposals

Other proposals such as block reallocation proposal and vote of confidence will follow the same voting cycle.

Supplementary website

While blockchain's as data storage is desired to maintain impartiality and anonymity of discussions, it is not a conducive medium for a wider discussion. A supplementary website will be made available to facilitate all proposal discussions and track the progress.

A good supplementary website is suggested to carry the following features:

- Proposer identification to facilitate meaningful discussion among the community and the proposer. This does not, however, imply the need of a user account system.

- Proposal extension and title hash validation. As the blockchain only contains the hash of title, the supplementary website must allow the proposer to enter the full proposal title hash and enter any additional descriptions on the proposals.

- Vote tracking. Ability to track votes as it happens.

An example good supplementary website would be https://www.dashcentral.org/budget for Dash.

Interchain Exchange

Goals

Allow users to trustlessly and seamlessly swap between DST and Bitcoin BTC. BTC in the rest of this document will only referring to BTC on Bitcoin blockchain and not BTC DST.

Key areas of focus, in decreasing order of importance:

- Safety

- User experience – it should be easily presentable on a client UI

- Seamlessness - most of the steps should be automated at client

Components

-

Hash Time Lock Contract

- A.k.a. HTLC

- Part of Bitcoin script, and DFC side, it's a new construct for DST.

- Requires both participants to be active.

- H = Hash(S)

-

Inter-chain Exchange

- A.k.a. ICX / XCX

- This is on-chain (DeFiChain) trustless exchange with "traditional" orderbook

-

SPV wallet

- Simple Payment Verification Bitcoin wallet

- Distributed as part of DeFiChain node

- This is why we are only supporting Bitcoin, at least for now.

Glossary

- Buyer vs Seller

- Maker vs Taker

Scenarios

2 scenarios:

-

DST seller maker, wants BTC

- Paired with BTC seller taker

-

BTC seller maker, wants DST

- Paired with DST seller taker

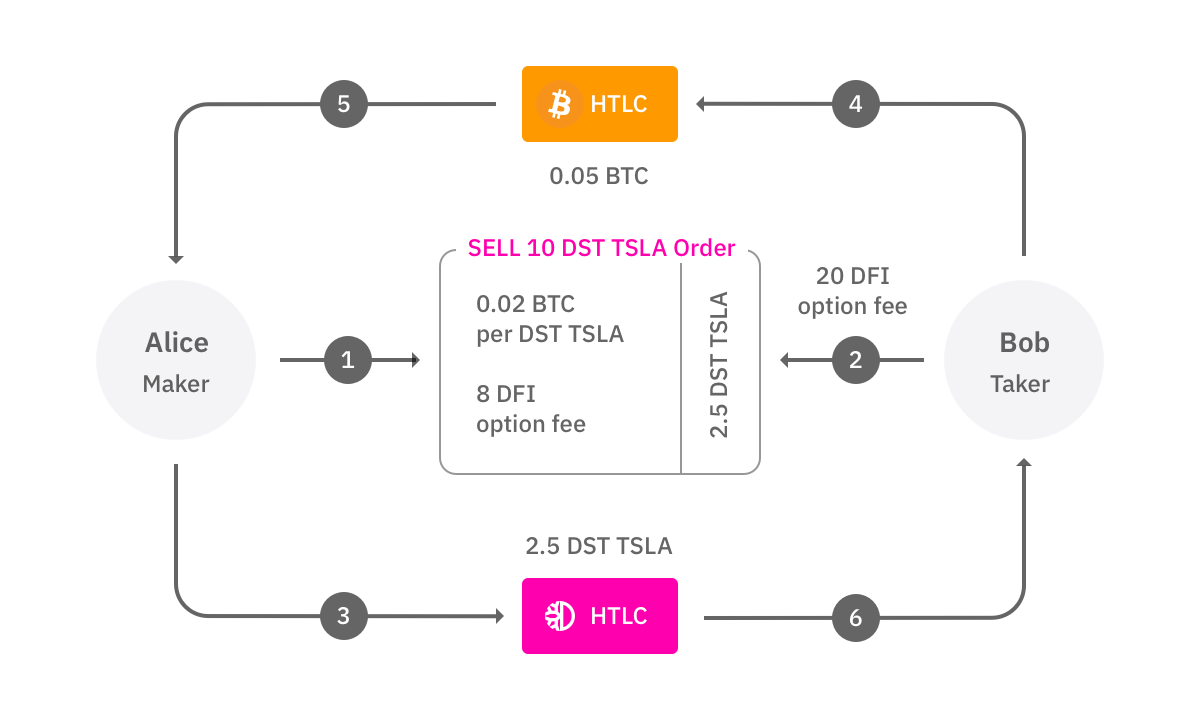

Scenario 1

Alice - Sells DST, wants BTC - Maker

Bob - Sells BTC, wants DST - Taker

-

Alice, as maker, puts up an order:

- For sale: 10 TSLA DST

- unitPrice: 0.02 (BTC - $800 each for BTC at $40k)

- expiry: 2880 blocks

- optionFeePerUnit: 8 (DFI)

-

Bob, as taker:

- Wants to buy just 2.5 TSLA, not all 10. (partial order)

- Makes an acceptance offer.

- Transmits

optionFeePerUnit * unit8 * 2.5 = 20 DFI alongside the order into HTLC. No payment DFI is locked up yet, only 20 DFI for optionFee - UX: either browse orderbook, or do a market order (easier: always match with the best price)

-

Alice accepts the offer

- UX side this is automatically accepted

- Moves 2.5 TSLA from the order into DFC DST HTLC (also known as ICX Contract).

- Properties of HTLC:

- 2.5 TSLA locked up for 120 blocks (1 hour)

- with H provided, where H = Hash(S) the funds for Bob can be unlocked from this HTLC.

-

Bob sees the DST HTLC, verifies the following:

- Amount, token, time locked up and recipient is correct.

- Waits for sufficient confirmation at DFC side to ensure finality.

- Bob, now initiates on the Bitcoin side, HTLC for:

- 2.5 * 0.02 = 0.05 BTC

- With the same H. Take note that Alice knows S, but Bob does not know S.

- Time limit is 30 minutes.

- Bob updates ICX C on this HTLC.

-

Alice accepting Bitcoin

- Alice confirms that HTLC properties are correct, amount, time, recipient.

- Waits for sufficient confirmation at Bitcoin blockchain to ensure finality.

- Claims Bitcoin by revealing S.

-

Bob now claims DST.

- Bob sees that Alice has claimed and revealed S.

- Bob claims DST too by using the same S.

- DST is claimed on ICX C itself, this sends DST to Bob, and refunds Bob the

optionFee.

Bad actors

- N/A

- N/A

- If Alice does not accept, Bob's offer expires after 20 blocks and takes back

optionFee. - If Bob does not honor the BTC side, Alice receives back her 2.5 TSLA after 1 hour +

optionFee.

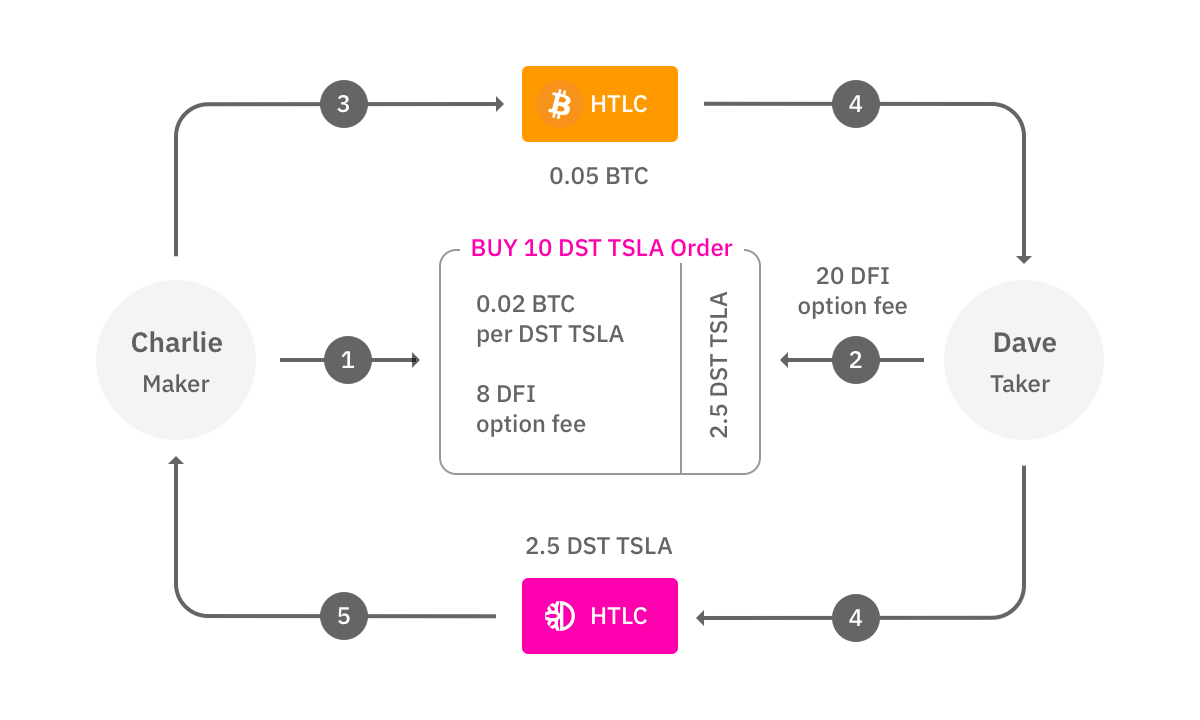

Scenario 2

Charlie - Sells BTC, wants DST - Maker

Dave - Sells DST, wants BTC - Taker

-

Charlie, as maker, puts up an order:

- Buying: 10 TSLA DST

- unitPrice: 0.02 (BTC - $800 each for BTC at $40k)

- expiry: 2880 blocks

- optionFeePerUnit: 8 (DFI)

-

Dave, as taker:

- Wants to sell just 2.5 TSLA, not all 10. (partial order)

- Makes an acceptance offer.

- Transmits

optionFeePerUnit * unit8 * 2.5 = 20 DFI alongside the order into HTLC. No payment DFI is locked up yet, only 20 optionFee DFI. - UX: either browse orderbook, or do a market order (easier: always match with the best price)

-

Charlie accepts the offer

- Charlie comes up with S. Computes H where H = Hash(S).

- Charlie locks up BTC on the Bitcoin HTLC for:

- 2.5 * 0.02 = 0.05 BTC

- With H. Take note that Charlie knows S, but Dave does not know S.

- Time limit is 1 hour (6 blocks).

- and creates ICX Contract with H, and Bitcoin HTLC address.

- Dave's

optionFeeis locked in ICX C.

-

Dave sees that Charlie has accepted the offer and that BTC is now locked in HTLC

- Validates that BTC HTLS is correctly set up - amount, time, recipient

- Waits for sufficient confirmation on BTC side to ensure finality.

- Moves 2.5 TSLA from the order into DFC ICX C (no need to provide H as contract already know H)

-

Charlie accepts DST

- Waits for sufficient confirmation on DFC side to ensure finality.

- Claims DST by revealing S

- This sends DST to Charlie and refunds

optionFeeto Dave.

-

Dave now claims BTC

- using the same S on the BTC HTLC

Bad actors

- N/A

- N/A

- If Charlie does not accept, Bob's offer expires after 10 blocks and takes back

optionFee. - If Bob does not honor the BTC side, Alice receives back her 2.5 TSLA after 1 hour +

optionFee.

Override Notice: Fees and Incentives

TODO: Cleanup this document to be coherent

The above document has parts overriden by the fees document.

Interchain Exchange fees

Game theory exploits

The following fees are suggested to prevent the following:

- Users could potentially take up their own orders to generate fake transactions.

- Users could potentially take up other users' orders to eliminate competition and increase own incentives returns.

- Users could leave their orders passively and not respond to take requests.

General ideas

- Negative maker fee

- Positive taker fee

- Also the DFI made by Maker, inclusive of bonus must be less than fees paid by Taker. Without it fake transactions would be generated to game rewards.

Fees

- Previous

optionFeeis now replaced with non-refundabletakerFee.- This is to deal the case where Alice refuses to accept Bob's valid HTLC (Scenario 1) and unfairly profits from

optionFee.

- This is to deal the case where Alice refuses to accept Bob's valid HTLC (Scenario 1) and unfairly profits from

takerFeeis in DFI and is fixed at consensus-set (takerFeePerBTC* BTC *DEX DFI per BTC rate).makerDepositbeing the same astakerFee.- It is refundable upon successful swap.

makerIncentive25% * takerFee

makerBonus50% * takerFeeif it's BTC parity trade. BTC DSTs eligible formakerBonusare consensus-set.

DST maker exiting to Bitcoin

- Maker, pays no fee, but locks up DST (consensus-verifiable).

- Taker makes offer, locks up

takerFee.- If offer is not accepted after timeout,

takerFeeis refunded.

- If offer is not accepted after timeout,

- Maker accepts offer, locks up DST (consensus-verifiable), burns

makerDeposit&takerFee.- If partial amount from offer is accepted, refunds unused

takerFeeproportionally back to Taker.

- If partial amount from offer is accepted, refunds unused

- Taker locks up BTC (non-consensus-verifiable) and updates ICXC on BTC HTLC.

- Maker verifies that BTC HTLC is correct, claims BTC.

- If Taker locks up incorrectly, both parties lose DFI (neither party wins)

- If Maker does not verify, both parties lose DFI (neither party wins)

- Taker claims DST on ICXC.

- Mints

makerDeposit(refund),makerIncentive&makerBonus(if any) to Maker. - Validate that the amounts are correct – no additional tokens are generated.

- Mints

BTC maker entering from Bitcoin

- Maker, pays no fee.

- Taker makes offer, locks up

takerFee.- If offer is not accepted after timeout,

takerFeeis refunded.

- If offer is not accepted after timeout,

- Maker accepts offer, locks up

makerDeposit. - Taker locks up DST (consensus-verifiable), burns both

takerFeeandmakerDeposit.- If Taker does not do it, burns

takerFeeand refundmakerDepositto Maker.

- If Taker does not do it, burns

- Maker locks up BTC (non-consensus-verifiable) and updates ICXC on BTC HTLC.

- Taker verifies that BTC HTLC is correct, claims BTC.

- If Maker locks up incorrectly, both parties lose DFI (neither party wins)

- If Taker does not verify, both parties lose DFI (neither party wins)

- Maker claims DST on ICXC

- Mints

makerDeposit(refund),makerIncentive&makerBonus(if any) to Maker. - Validate that the amounts are correct – no additional tokens are generated.

- Mints

Loan and Decentralized Tokenization

Loan is be offered by operator to allow decentralized price-tracking tokens to be created by users.

Before Operator model is ready, it uses only 1 default opspace and requires foundation authorization, that acts on behalf of community.

Possibility of tokens being offered in a decentralized manner can be of many types, including but not limited to:

- Cryptocurrency such as

BTC,ETH,LTC, etc. - Stablecoin such as

USD,EURtokens, etc. - Stocks token such as

TSLA,MSFT, etc. - Other asset tokens.

Concepts

Collateralization ratio

Loan on DeFiChain operates on over-collateralization mechanism. User first has to open a vault to mint tokens.

Collateralization is calculated for each vaults, using the following formula:

Collateralization ratio =

Total effective value of collateral /

(Total value of tokens minted + Total interest)

For example, if a vault holds $200 worth of collateral asset, with $90 minted tokens and $10 of total interest accrued, the collateralization ratio is 200 / (90 + 10) = 2.

This is not to be confused with collateralization factor.

Collateralization factor

Assets that are accepted for collateralization could be accepted at different collateralization factor, from 0% to 100%. When an asset collateralization factor is 100%, the entirety of the asset's value contributes to the collateralization value of the vault, however, if an asset collateralization factor is say 50%, then only half of its value contributes to the total vault's collateral.

For example if DOGE is accepted at 70% collateralization factor, $100 of DOGE would contribute to $70 of collateral value in a vault.

This is not to be confused with collateralization ratio.

Operator

Operator plays to role to decide on the following:

- Collateral tokens and their respective collateralization values.

- For instance, an Operator can decide to allow users to start a Vault in their opspace with the following collateralization factors:

DFIat 100% collateralization factorBTCat 100% collateralization factorDOGEat 70% collateralization factor

- For instance, an Operator can decide to allow users to start a Vault in their opspace with the following collateralization factors:

Operator, also via opspace's governance values, can decide the following:

LOAN_LIQUIDATION_PENALTY: 0.05 (default), for 5% liquidation penalty. This is converted into DFI upon liquidation and burned.

Loan scheme

Loan scheme allows an operator to set up different loan schemes under the same Operator. Loan schemes allows an operator to define the following:

- Collateral token and different collateralization factor

- Loan interest rates

For example, a series of loan schemes could be made available:

- Min collateralization ratio: 150%. Interest rate: 5% APR.

- Min collateralization ratio: 175%. Interest rate: 3% APR.

- Min collateralization ratio: 200%. Interest rate: 2% APR.

- Min collateralization ratio: 350%. Interest rate: 1.5% APR.

- Min collateralization ratio: 500%. Interest rate: 1% APR.

- Min collateralization ratio: 1000%. Interest rate: 0.5% APR.

Vault owner can define which loan scheme to subscribe to during initial vault creation and can move it freely after that. Take caution though that if you move to a scheme with lower collateralization ratio, liquidation might be triggered.

Interest rate

Interest rate for loan consists of 2 parts:

- Vault interest, based on loan scheme of individual vaults

- Token interest, based on loan tokens, e.g.

TSLAtoken might have its own interest that is chargeable only forTSLAtoken.

DeFi fees are burned. Fees are typically collected in the form of the loan token repayment, and automatically swapped on DEX for DFI to be burned.

For example, if a loan of 100 TSLA is taken out and repaid back exactly 6 months later with the APR of 2%, the user will have to repay 101 TSLA during redemption to regain full access of collateral in the vault.

100 TSLA will be burned as part of the repayment process. 1 TSLA that forms the interest payment will be swapped on DEX for DFI. The resulting DFI will burned. All of these occur atomically as part of DeFiChain consensus.

Vault

User is able to freely open a vault and deposit tokens to a vault. Vault is transferable to other owners, including being controlled by multisig address.

Collateral DFI requirement

Vault's collateral requires at least 50% of it to be DFI.

When depositing non-DFI collateral to a vault, it needs to ensure that the resulting DFI proportion of for vault's collateral is at least 50% or more, or the deposit transaction should fail.

This requirement is only checked upon deposited and does not play a role in liquidation. For instance, if at the time of posit, a vault's DFI collateral is 52%, but falls to 49% without any further deposit. This WILL NOT trigger liquidation as long as vault's minimum collateralization ratio condition is still met.

States

- "active" : Vault is above its collateralization ratio and both collaterals and loans price feeds are valid.

- "frozen" : Any of collateral or loan price feed is invalid. No action can be undertaken while vault is frozen.

- "inLiquidation" : Vault is under liquidation and has undergoing auctions.

- "mayLiquidate" : Vault will liquidate at the next price update.

Liquidation

Liquidation occurs when the collateralization ratio of a vault falls below its minimum. Liquidation is crucial in ensuring that all loan tokens are sufficiently over-collateralized to support its price.

For Turing-complete VM-based blockchain, liquidation requires the assistance of publicly run bots to trigger it, in exchange for some incentives.

There are two problems with that:

- During major price movements, the network fee, or commonly known as gas price, would sky rocket due to a race by both the vault owners frantically trying to save their vaults from getting liquidated, and by the public liquidators trying to trigger liquidation.

- If liquidations are not triggered on time, tokens that are generated as a result of loan runs the risk of losing its values. Worse scenario would see it getting into a negative feedback loop situation creating a rapid crash of token values.

DeFiChain, a blockchain that's built for specifically for DeFi, enjoy the benefit of automation and can have liquidation trigger automatically on-chain. This address the above two problems.

Methodology

On every block, the node would evaluate all vaults and trigger the following automatically for liquidation.

When collateralization ratio of a vault falls below minimum collateralization ratio, liquidation would be triggered. During liquidation collateral auction is initiated.

When a vault is in liquidation mode, it can no longer be used until all the loan amount is repaid before it can be reopened. Interest accrual is also stopped during liquidation process.

Collateral auction

The entirety of loan and collateral of a vault if put up for auction. As the first version of collateral auction requires bidding of the full amount, auction is automatically split into batches of around $10,000 worth each to facilitate for easier bidding.

Example

A vault, that requires a minimum of 150% collateralization ratio contains $15,000 worth of collateral, which consists of $10,000 worth of DFI and $5,000 worth of BTC, and the total loan, inclusive of interest, is $11,000 worth.

- Collateral: $10,000 DFI + $5,000 BTC

- Loan: $10,000

TSLA+ $1,000 interest (TSLA)

Collateralization ratio = 15k / 11k = 136.36% less than the required 150%. Liquidation is triggered automatically by consensus. Auction will be initiated with the intention to liquidate $15k of collateral to recover $11k of loan.

Liquidation penalty is defined as LOAN_LIQUIDATION_PENALTY. The amount to be recovered should also include the penalty. If LOAN_LIQUIDATION_PENALTY is 0.05, the total amount to be recovered is thus $11k * 1.05 = $11,550

Total collateral worth is $15k, it will thus be split into 2 batches, each not exceeding $10k:

- 2/3 of the whole vault, worth $10k of collateral.

- 1/3 of the whole vault, worth $5k of collateral.

Specifically the following:

- ($6,667 DFI and $3,333 BTC) for $7,700

TSLA - ($3,333 DFI and $1,667 BTC) for $3,850

TSLA

TSLA recovered at the conclusion of the auction will be paid back to the vault. Once all loan is repaid, vault will exit liquidation state, allowing its owner to continue to use it. It will, however, not terminate all opened auctions. Opened auctions see through to their conclusion.

Collateral auction

Collateral auction will run for 720 blocks (approximately 6 hours) with the starting price based on liquidation vault's ratio.

Using the same illustration, Auction 1: ($6,667 DFI and $3,333 BTC) for $7,700 TSLA

Anyone can participate in the auction, including the vault owner by bidding for the entirety of the auction with higher amount. To prevent unnecessary auction sniping at closing blocks, each higher bid, except the first one, has to be at least 1% higher than previous bid.

A user could bid for the same auction by offering $7,800 worth of TSLA tokens. During bidding, the bid is locked and refunded immediately when outbid. Top bid is not cancelable.

At the conclusion of the auction, the entirety of the for sale collateral will be transferred to the winner – in this case the winner would be paying $7,800 for $10,000 worth of BTC and DFI.

$7,800 worth of TSLA token will be processed as follow:

- Paid back to vault = $7,800 worth of

TSLA/ (1 +LOAN_LIQUIDATION_PENALTY) = 7800 / 1.05 = $7,428.57TSLAtoken - The remaining, i.e. liquidation penalty, will be swapped to DFI and burned. $371.43 worth of

TSLAbe swapped as follows and trackably burned:TSLAtoUSDfromTSLA-USDDEX.USDtoDFIfromUSD-DFIDEX.

If auctions yield more TSLA than the vault's loan, it will be deposited back to the vault as part of vault's asset, but not collateral. It can be withdrawn from the vault after vault exits liquidation state by vault's owner and carries no interest.

Multiple loan tokens

If a vault consists of multiple loan tokens, they should be auctioned separately.

For instance, a liquidating vault that consists of the following:

- Collateral: 1 BTC & 100 DFI

- Loan: $10k worth of USD * $40k worth TSLA

would be liquidated as follows:

- (0.2 BTC & 20 DFI) for $10k worth of USD

- (0.8 BTC & 80 DFI) for $40k worth of TSLA

and further split into $10k batches.

Failed auction

Auction that expires after 720 blocks without bids will be reopened immediately based on the remaining amount of collateral and loan that the vault receives due to conclusion of other auction batches.

RPC

Operator

Requires Operator authorization. Before Operator model is ready, it uses only 1 default opspace and requires foundation authorization.

Loan scheme

-

createloanscheme DATADATA(JSON) can consist of the following:mincolratio: e.g. 175 for 175% minimum collateralization ratio. Cannot be less than 100.interestrate: Annual rate, but chargeable per block (scaled to 30-sec block). e.g. 3.5 for 3.5% interest rate. Must be > 0.id: Non-colliding scheme ID that's unique within opspace, e.g.MIN_175

-

updateloanscheme MIN_COL_RATIO INTEREST_RATE SCHEME_ID [ACTIVATE_AFTER_BLOCK]- Update loan scheme details.

ACTIVATE_AFTER_BLOCK(optional): If set, this will only be activated after the set block. The purpose is to allow good operators to provide sufficient warning.

-

destroyloanscheme SCHEME_ID [ACTIVATE_AFTER_BLOCK]- Destroy a loan scheme.

ACTIVATE_AFTER_BLOCK(optional): If set, this will only be activated after the set block. The purpose is to allow good operators to provide sufficient warning.- Any loans under the scheme will be moved to default loan scheme after destruction.

-

setdefaultloanscheme SCHEME_ID- Designate a default loan scheme from the available loan schemes.

General

-

setcollateraltoken DATADATA(JSON)token: Token must not be the same decentralized token is issued by the same operator's loan program.factor: A number between0to1, inclusive.1being 100% collateralization factor.fixedIntervalPriceId: Token/currency pair to track token price.activateAfterBlock(optional): If set, this will only be activated after the set block. The purpose is to allow good operators to provide sufficient warning to their users should certain collateralization factors need to be updated.- This very same transaction type is also used for updating and removing of collateral token, by setting the factor to

0.

-

setloantoken DATA- Creates or updates loan token.

DATA(JSON)symbolToken's symbol (unique), not longer than 8nameToken's name (optional), not longer than 128fixedIntervalPriceId: Token/currency pair to track token price.mintable(bool): When this istrue, vault owner can mint this token. (defaults to true)interest: Annual rate, but chargeable per block (scaled to 30-sec block). e.g. 3.5 for 3.5% interest rate. Must be >= 0. Default: 0.

- To also implement

updateloantokenandlistloantokens.

Public

Requires no authorizations.

-

getloaninfo- Returns the attributes of loans offered by Operator.

- Includes especially the following:

- Collateral tokens: List of collateral tokens

- Loan tokens: List of loan tokens

- Loan schemes: List of loan schemes

- Collateral value (USD): Total collateral in vaults

- Loan value (USD): Total loan token in vaults

-

listloanschemes- Returns the list of attributes to all the available loan schemes.

Vault

Vault-related, but does not require owner's authentication.

-

createvault [OWNER_ADDRESS] [SCHEME_ID]- Create a vault for

OWNER_ADDRESS. - No

OWNER_ADDRESSauthorization required so that it can be used for yet-to-be-revealed script hash address. - 2 DFIs needed for createvault.

- 1 DFI burned, and 1 added to collateral.

- The last 1 added to collateral will be reclaimed on closevault.

- Create a vault for

-

deposittovault VAULT_ID TOKEN_TO_DEPOSIT- Deposit accepted collateral tokens to vault.

- Does not require authentication, anyone can top up anyone's vault.

TOKEN_TO_DEPOSITshould be in similar format as other tokens on DeFiChain, e.g.23.42@USDCand0.42@DFI.- Also take note on the >= 50% DFI requirement, when depositing a non-DFI token, it should reject if the total value of the vault's collateral after the deposit brings DFI value to less than 50% of vault's collateral.

- This also means that the first deposit to a vault has to always be DFI.

-

paybackloan DATADATA(JSON)vaultId: loan's vault ID.from: Address containing repayment tokens.amounts: Amounts to pay back in amount@token format.

- Pay back of loan token.

- Only works when there are loans in the vault.

- Refunds additional loan token back to original caller, if 51.1

TSLAis owed and user pays 52TSLA, 0.9TSLAis returned as change to transaction originator (not vault owner). - Does not require authentication, anyone can payback anyone's loan.

-

getvault [VAULT_ID]- Returns the attributes of a vault.

- Includes especially the following:

- Owner address

- Loan scheme ID

stateCan be one ofactive,frozen,inLiquidationandmayLiquidate. See state

-

listvaults- Returns the list of attributes to all the created vaults.

Vault owner

Requires ownerAddress authentication, and vault MUST NOT be in liquidation state.

-

updatevault VAULT_ID DATADATA(JSON) may consists of the following:scheme: Allows vault owner to switch to a different schemeownerAddress: Transfers vault's ownership to a new address.

-

withdrawfromvault VAULT_ID TO_ADDRESS AMOUNT- Withdraw collateral tokens from vault.

- Vault collateralization ratio must not be less than

mincolratioof vault's scheme. - Also used to withdraw assets that are left in a vault due to higher auction yield. See Collateral auction

-

takeloan DATADATA(JSON)vaultId: ID of vault used for loan.to: Address to transfer tokens (optional).amounts: Amount in amount@token format.

- Vault collateralization ratio must not be less than

mincolratioof vault's scheme.

Auction

Requires no additional authentications.

-

listauctions -

auctionbid VAULT_ID INDEX FROM AMOUNT-

VAULT_ID: Vault id. -

INDEX: Auction index. -

FROM: Address to get tokens. -

AMOUNT: Amount of amount@symbol format. -

TOTAL_PRICEof token in auction will be locked up until the conclusion of the auction, or refunded when outbid.

-

Operator

Generalization

Generalization effort in DeFiChain aims at separation between the role of blockchain and operator, the party in charge of offering financial products.

The generalization goals are to allow anyone to create and run as operator on DeFiChain, without requiring any prior permissions from DeFiChain Foundation or its developers.

Opspace

Operator operates exclusively within their Opspace and does not interfere with the operations of other Opspaces and entire blockchain ecosystem.

To ensure operation continuity, the current asset tokens, and any other offerings that are available prior to the introduction of Operator, will be migrated to the first Opspace when the functionality is available.

Role

The role and functionalities available to operators include:

- Price oracle

- Setting of price feeds.

- Appointing of oracles.

- Asset token

- Determining and setting of asset tokens that are available within an opspace.

- Previously referred to as "DeFi Asset Token" on white paper.

- Decentralized loan

- Determining loan attributes: collateral types, interest rates, etc

- Futures

- Determining future offerings & attributes

... and others as they are made available.

Operator is also free to determine their own Operator fee for all the products that they provide.

Note that operators may only want to participate in a subset of the operations available, for example an operator may only be interested in offering decentralized loan but not interested in offering futures.

Operations

RPC is designed work with multisignatory opcodes of Bitcoin's script, allowing operator to have clear governance over its policies.

-

createoperator- Costs 1000 DFI in DeFi fee, burned.

-

updateoperator

Price oracle

Even though Oracle could technically provide any off-chain data, the initial version of Oracle focuses on numeric data especially price feeds to augment various features and functionalities on DeFiChain, especially future, option & loan.

Economics & game theory

To provide a fully robust trustless oracle service requires components such as reputation, penalty, and various other mechanics, it is not DeFiChain's current focus to build a full oracle system, at least at this stage. DeFiChain utilizes Operator and free economy to ensure that oracles are run as fairly as possible. It is Operator's interest to ensure that oracles that they appoint are fairly run, and users are free to select operators that they like.

Mechanics

While truthfullness of the data cannot be assertained on the blockchain alone, the goals of the design should focus on building a robust oracle system that should continue to function fine with a few minotirty oracle outages.

Price feeds

Price feed should be 8 decimal places.

Requires foundation authorization.

createpricefeed BTC_USD_PRICEremovepricefeed BTC_USD_PRICE

Oracle appointments

Requires Operator authorization. Before Operator model is ready, it uses only 1 default opspace and requires foundation authorization.

appointoracle ADDRESS '["BTC_USD_PRICE", "ETH_USD_PRICE"]' WEIGHTAGE- returns

oracleid.oracleidshould be a deterministic hash and not incremental count. WEIGHTAGEis any number between 0 to 100. Default to 20.

- returns

removeoracle ORACLEIDupdateoracle ORACLEID ADDRESS '["BTC_USD_PRICE", "ETH_USD_PRICE"]' WEIGHTAGE

Price feeds operations

Requires appointed Oracle authorization.

setrawprice TIMESTAMP '{"BTC_USD_PRICE": 38293.12}'- Raw price update should only be valid if timestamp is within one hour from the latest blocktime.

- timestamp is there so that updates that are stuck in mempool for awhile does not get accepted after timeout.

General usage

General usage, requires no authorizations.

-

listlatestrawprices BTC_USD_PRICE- Also supports

listlatestrawpricesto list across all feeds. - Returns an array of all the latest price updates, e.g.

[ { "pricefeed": "BTC_USD_PRICE", "oracleid": "ORACLEID", "weightage": 50, "timestamp": "timestamp of the last update", "rawprice": 38293.12000000, "state": "live" } ]- Price updates that are older than 1 hour from the latest blocktime would have its state to be

expired. - It is also imperative that the node is not storing all raw price data on database, it only needs to know the latest raw price for each oracles.

- Also supports

-

getprice BTC_USD_PRICE- Returns number with aggregated price.

- Aggregate price = Sum of (latest rawprice of live oracles * weightage) / Sum (live oracles' weightage)

- If no live oracle is found for the price, it should throw an error. It MUST NOT return 0 or large number.

-

listprices- Same as above, but an array of all feeds.

DFIP-2203

Proposal

For the community discussion that led to the addition of this feature, please have a look at the Reddit post and hear the Twitter Space.

For the proposal, refer to this link

DFIP summary :

- Introduce future trading for settling dToken prices once a week (7*2880 blocks).

- Establish 2 different Future contracts - one for the premium case and on for the discount case.

- Range for settlement should be +/-5%, which allows anticipating the next price in case of closed markets (constant oracle price)

- Premium future should trade 5% above the oracle price - you can buy dTokens with a 5% fee)

- Discount future should trade 5% below the oracle price - you can sell dTokens with a 5% discount)

- Futures will be a weak binding of DEX price to oracle price: between settlement time higher/lower deviations are possible

- Introducing an additional swap fee of 0.1% for every dToken pool to burn dTokens. The fee should be conducted for both swap directions.

- Strengthen dUSD by counting them in the same way as the mandatory 50% DFI in vaults with fix price of $0.99.

Related PRs:

Governances variables

v0/params/dfip2203/active

This variable determines wether the DFIP is activated or not. When disabled, no more deposit to the smart contract address will be accepted nor any swap will be executed.

v0/params/dfip2203/reward_pct

The percent of premium deducted at the moment of the swap.

v0/params/dfip2203/period_blocks

The block interval between two future swaps.

v0/token/<token_id>/dfip2203_disabled

Defaults to false. Used to blacklist certain token.

RPC commands

getfutureswapblock

Get the next block when the contract will be executed.

defi-cli getfutureswapblock

895100

futureswap

Parameters :

address: Address to fund contract and receive resulting token.amount: Amount to send in amount@token format.destination: Optional. Expected dToken if DUSD amount supplied.

Deposit DUSD or dTokens to be swapped at the next block interval.

defi-cli futureswap <address> <amount> <destination>

fd55837215c7ff29ba43afb196ffbfba8c20f16eb9dbba30ba829853f15b2aeb

withdrawfutureswap

Parameters :

address: Address to fund contract and receive resulting token.amount: Amount to send in amount@token format.destination: Optional. Expected dToken if DUSD amount supplied.

Withdraw DUSD or dTokens previously deposited.

defi-cli withdrawfutureswap <address> <amount> <destination>

bceb216add60c38888d102c737d73d3a559fc214bbe18cab92848a8d31586944

listpendingfutureswaps

List all pending futures.

defi-cli listpendingfutureswaps

[{'owner': 'mg1qAZBb28tuWpxNmbRvZha9zhUpEQ5uVx', 'source': '1.00000000@MSFT', 'destination': 'DUSD'}, {'owner': 'mhe4v9VMpinWfJpgUqpmyEXeUXc1AdFoVC', 'source': '1.00000000@GOOGL', 'destination': 'DUSD'}, {'owner': 'mk5RKGj4nNiVPhKvrVqkUh7oX2oGXvtXc5', 'source': '1.00000000@TSLA', 'destination': 'DUSD'}, {'owner': 'msyMCXeC12XwzJ8CbZTbDyDAem3PsWFrRJ', 'source': '1.00000000@TWTR', 'destination': 'DUSD'}]

getpendingfutureswaps

Get all pending futures for a specific address.

Parameters :

address: Address to get futures prices for.

defi-cli getpendingfutureswaps <address>

{'owner': '<address>', 'values': [{'source': '1.00000000@MSFT', 'destination': 'DUSD'}]}

listgovs

All the governance variables related to this DFIP can be accessed via listgovs

defi-cli listgovs

{

...,

"ATTRIBUTES": {

"v0/params/dfip2203/active": "true",

"v0/params/dfip2203/reward_pct": "0.05",

"v0/params/dfip2203/block_period": "20160",

"v0/token/10/dfip2203_disabled":"true",

}

}

Guides

Blockchain Node - defid

DeFiChain is a distributed network of computers running software (known as nodes). DeFiChain nodes are able to

- Store all blockchain data

- Serve data to lightweight clients

- Validate and propogate blocks and transactions

Every DeFiChain node runs an implementation of the DeFiChain protocol, and can be run on local and cloud machines. The recommended requirements for running the reference defid node are

- Desktop or laptop hardware running recent versions of Windows, Mac OS X, or Linux.

- Atleast 30 GB of disk space (Minimum: ~8GB)

- Atleast 8 gigabytes of physical memory (RAM) (Minimum: ~1GB, but isn't recommended and sufficient swap is required)

- 4 GB of swap space (Minimum: None, but highly recommended to give room for memory fragmentation spikes)

There are two ways start using the node - using the compiled releases or compiling the souce code on your own.

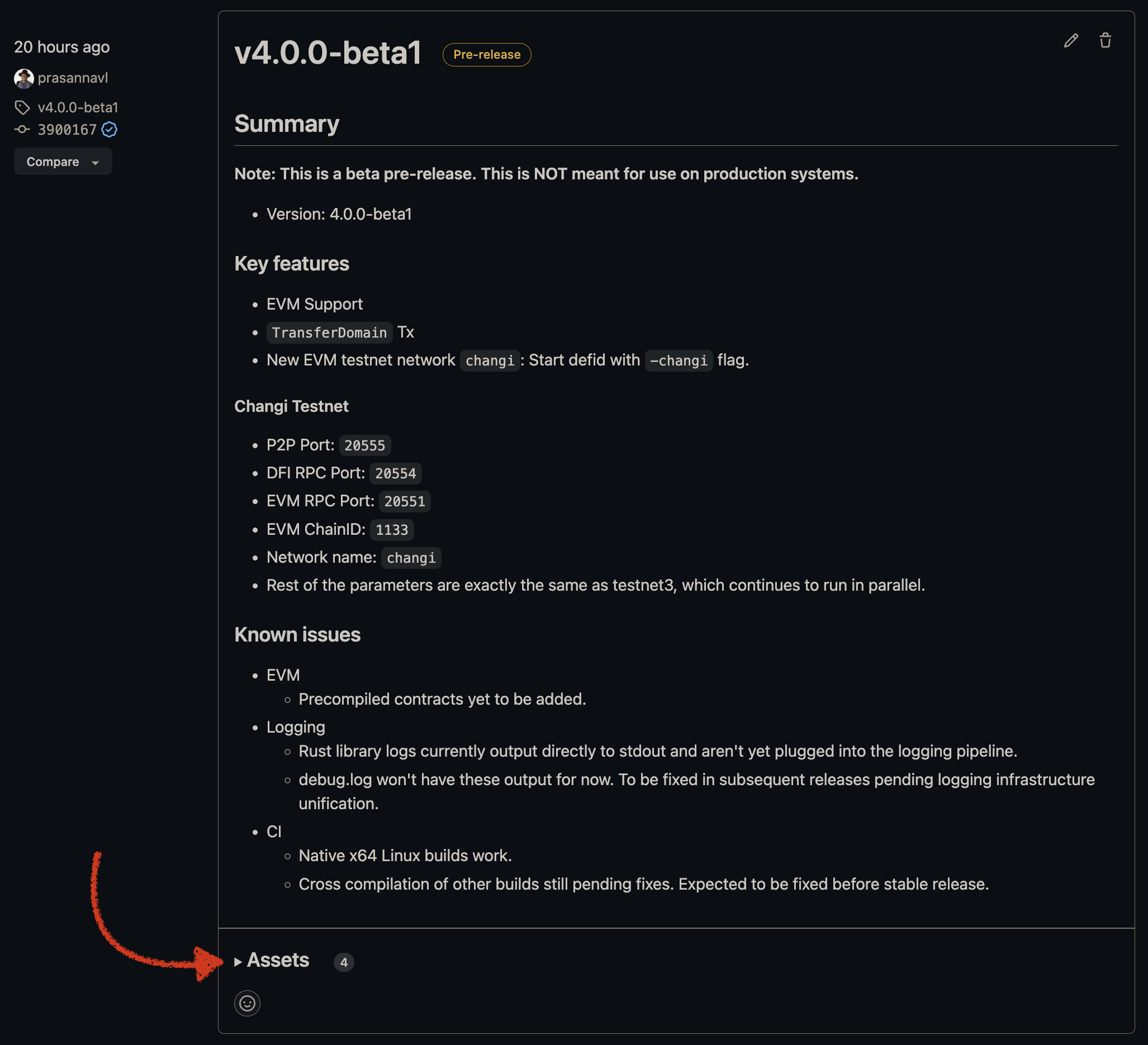

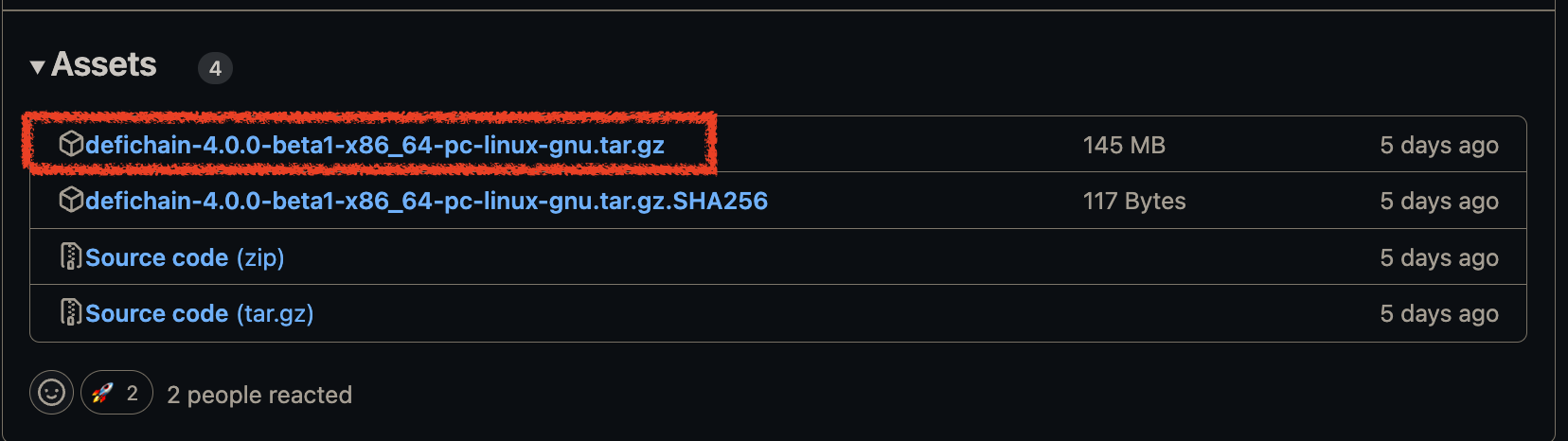

Using compiled releases

Download the latest available release from Github. Extract the archive by using an archive manager, or running the following command in a terminal

tar xzf <filename>.tar.gz # replace <filename> with the filename downloaded file

You can run the following install command to globally install the DeFiChain binaries.

sudo install -m 0755 -o root -g root -t /usr/local/bin <defichain-path>/bin/* # replace <defichain-path> with the path to the root of the extracted folder

Proceed to Initial Block Download.

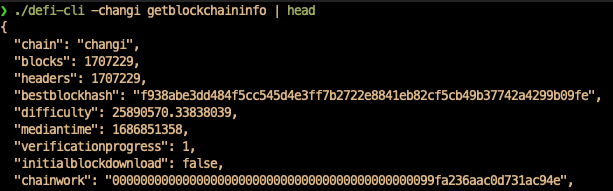

Initial Block Download

Once you have the required binaries available, you can start the node by running the following commands in the folder with the executables.

Linux and macOS: ./defid

Windows: defid.exe